You are viewing 1 of your 1 free articles

‘Challenging conditions’ continue for L&Q as surplus falls in first quarter

L&Q’s surplus has fallen again in the first quarter of the financial year as it said it expected “challenging conditions” to continue right up to 31 March 2020.

In a trading update for the first quarter of 2019/20, London’s largest housing association revealed that its surplus for the period was £31m, a 38% decrease on £50m, the figure for the same quarter in the previous year.

This follows the 104,000-home association’s surplus falling by almost half in the last financial year, with rising fire safety and maintenance costs combining with a struggling London market to reduce it from £348m to £190m.

A 67% drop in L&Q’s turnover from market sale, which went from £82m to £27m, was the main culprit for the association’s 22% drop in overall turnover, from £229m to £178m.

This happened against a difficult backdrop for housing associations trying to sell homes outright in the capital. London house prices have been falling consistently for a year, the first time this has happened since the global financial crisis.

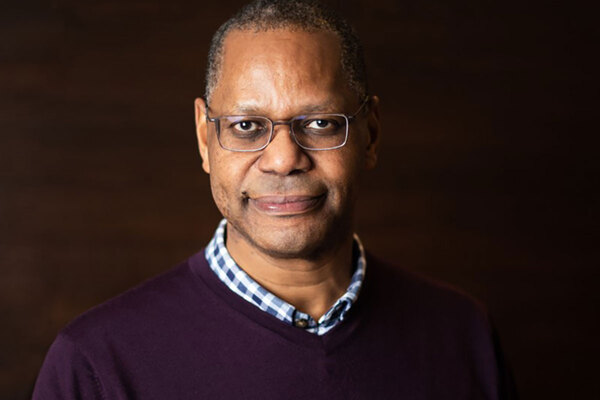

Waqar Ahmed, group finance director at L&Q, said: “L&Q expects challenging conditions to persist throughout the financial year to 31 March 2020 as we balance our key priorities against political and economic uncertainty.

“However, we continue to remain confident in our future prospects as we scale back development of outright sales for alternative tenures and only seek to approve longer-term strategic sites that require minimal initial capital outlay.”

In L&Q’s update, it revealed that it also had 478 unsold homes on 30 June this year, with a projected value of £173m. It said that 64% of these have been held for more than a month. Of these, 277 were for outright sale and 201 were for shared ownership.

The update also included the latest news on L&Q’s proposed acquisition of North West housing association Trafford Housing Trust, which it said would see it invest £4bn and build 20,000 homes in the region over the next 10 years.

L&Q said the acquisition has been delayed from its original date of June this year and will now happen in October “as customary closing conditions are completed”.

According to the update, L&Q still plans to spend £7bn on new homes over the next 21 years and currently has a total development of 51,700 new homes, 36% of which are on site.

Housing association financial statements 2018/19

A2Dominion’s surplus falls by 74%

Aster's surplus rises as it eyes land acquisitions

BPHA surplus falls after bumper year of spending

Catalyst's surplus plunges 45% as sales market slows

Clarion’s surplus falls for third year running

Hyde reveals £17m spend on fixing post-Grenfell defects

Metropolitan Thames Valley shared ownership surplus tumbles

Network Homes boost surplus by 62%

Notting Hill Genesis customer satisfaction rate only 65%

Paradigm’s surplus falls slightly thanks to development difficulties

Peabody's self-imposed rent cut hits margin

Optivo returns to surplus after refinancing

Orbit surplus falls 52% as sales income slips

L&Q sees surplus drop by 42% in ‘challenging’ year

Southern reports 14% slide in surplus as fire safety checks increase

Sovereign's private sales income up 24%

Stonewater sees surplus fall by 43%

Swan surplus dives as cost to fix ACM cladding remains uncertain

WM Housing swings back into the black ahead of rebrand